Pay Stub Sample Templates: Create Professional Pay Stubs Easily

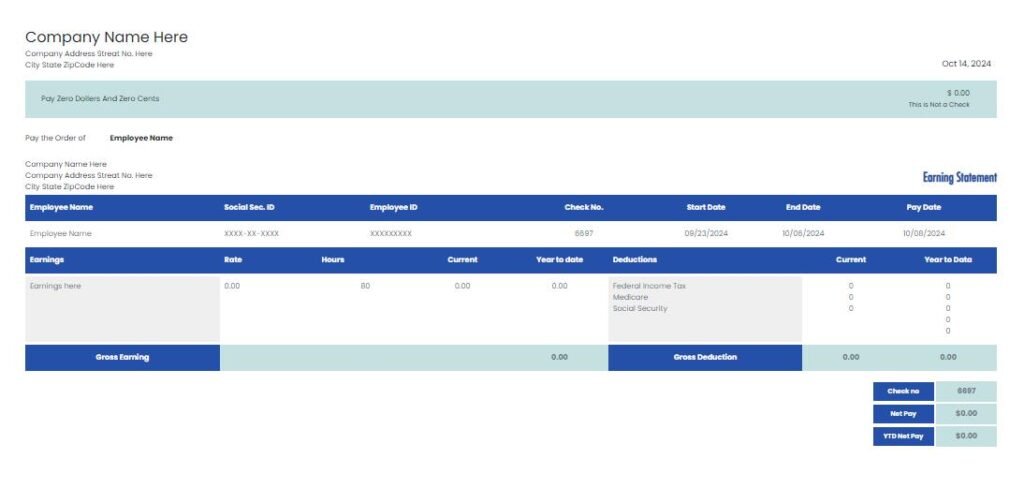

What is a Pay Stub? A pay stub is a document that details an employee’s earnings, deductions, and net pay. Employers issue pay stubs weekly, biweekly, or monthly, depending on their payroll cycle. Why Are Pay Stubs Important? Benefits of Using Pay Stubs Using pay stubs offers multiple advantages, from financial tracking to legal protection. Here’s why they are essential: Pay Stub Template A pay stub template, also called a paycheck stub template, is a structured document used to outline an employee’s earnings and deductions. It serves as a record of income, providing essential details about wages, taxes, and other withholdings. Employers can use a pay stub template to generate accurate payment records, ensuring transparency in payroll management. These templates also act as proof of income, making them useful for loan applications, renting agreements, and financial documentation. Various pay stub examples are available to fit different payroll schedules, including weekly, biweekly, and monthly pay stubs, catering to diverse business needs. Types of Pay Stub Templates When it comes to generating pay stubs, a one-size-fits-all approach doesn’t work. Different businesses have unique payroll needs, and choosing the right pay stub template ensures accuracy and efficiency. Here are some common types: How to Create a Pay Stub Online Using a pay stub generator simplifies payroll processing, ensuring accuracy, compliance, and security. Our platform makes it easy with real-time updates and robust data protection measures. Selecting a Pay Stub Template Entering Employer and Employee Details Adding Earnings and Deductions Using Excel or Google Sheets Creating pay stubs doesn’t always require specialized software. Google Sheets and Excel are powerful tools that can be used to create professional pay stubs with ease. Here’s how you can use these tools effectively: Using Google Sheets or Excel for creating pay stubs offers flexibility and control, allowing you to tailor the pay stubs to your business’s unique needs. Why Use an Online Pay Stub Maker? Online pay stub makers transform payroll processing by allowing businesses to generate accurate and professional pay stubs quickly. These tools provide efficiency, customization, and convenience, making payroll management seamless. Key Benefits of Online Pay Stub Makers State Requirements for Pay Stubs While federal law doesn’t mandate pay stubs, the Fair Labor Standards Act (FLSA) requires employers to maintain payroll records. State laws vary: Key Information on a Pay Stub Calculating Net Pay Common Pay Stub Errors to Avoid Troubleshooting Pay Stub Templates Even with the best pay stub templates, you might encounter some issues. Here are some common troubleshooting tips to help you resolve these problems: By following these tips, you can effectively troubleshoot pay stub templates and ensure that your payroll process is accurate and efficient. Best Practices for Payroll Management Conclusion A well-structured pay stub sample template simplifies payroll management, ensuring accuracy, compliance, and professionalism. Whether using an Excel pay stub template or an online generator, businesses can streamline payroll tasks efficiently. Looking for an easy way to create pay stubs? Try our online pay stub generator today! FAQs About Pay Stub Templates

Pay Stub Sample Templates: Create Professional Pay Stubs Easily Read More »