How Pay Stubs Help Build Your Financial History for a Stronger Future

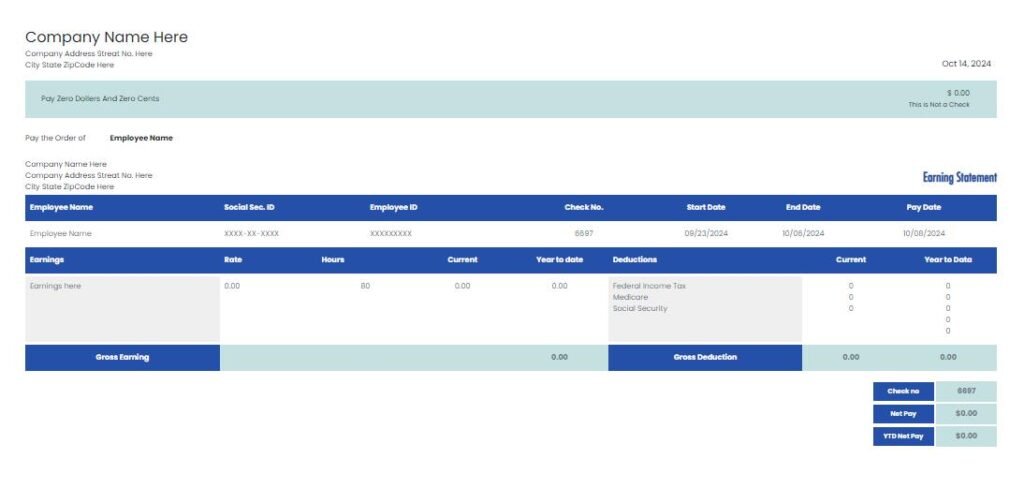

Introduction Pay stubs play a vital role in financial management by providing a detailed breakdown of earnings, deductions, and net pay. They help employees and independent contractors maintain financial transparency, track income, and secure loans or credit. Understanding Pay Stubs A pay stub is a document that summarizes an employee’s gross pay, taxes, deductions, and net pay. It can be provided in printed format or electronically, especially for those receiving direct deposit. Information on a Pay Stub: Pay Period The information on a pay statement varies according to an employee’s tax liability, benefit contributions, and state or local requirements. The pay period is essential for correctly reporting hours worked, including overtime, and aligning pay stubs with tax documents like W-2 forms. Most pay statements include details such as gross pay, taxes, deductions, and net pay. Pay stubs may also include deductions for health insurance premiums, 401(k) contributions, and any wages that have been garnished. Calculating Net Pay Who Needs to Prove Income Using a Pay Stub? Creating and Managing Pay Stubs Digital vs. Paper Pay Stubs In today’s digital age, pay stubs can be delivered in various formats, including digital and paper. While some employers still provide paper pay stubs, many have switched to digital pay stubs, which can be accessed online or through a mobile app. Digital pay stubs offer several benefits, including convenience, reduced paper waste, and increased security. Employees can easily access their pay stubs anytime and anywhere, making it easier to keep track of their financial records. However, some employees may prefer paper pay stubs for record-keeping purposes or for those who do not have access to digital devices. Ultimately, the choice between digital and paper pay stubs depends on personal preference and accessibility. State Requirements for Pay Stubs Although no federal laws require employers to provide pay statements to employees, the federal government mandates that employers follow both federal and state recordkeeping laws. Many state and local jurisdictions do require pay statements. The Fair Labor Standards Act requires employers to “keep employee time and pay records”. Some states have opt-out or opt-in requirements for electronic pay stubs. Supporting Financial Records Along with pay stubs, maintaining financial documents like: Keeping these records organized and secure is important for financial planning and security. Privacy and Security Impact of Pay Stubs on Credit Scores Pay stubs can have an indirect impact on credit scores. When applying for credit, such as a mortgage or car loan, lenders often request pay stubs as proof of income. A pay stub can demonstrate a borrower’s ability to repay the loan, which can positively affect their credit score. Consistent and accurate pay stubs show a stable income, reassuring lenders of the borrower’s financial reliability. However, errors or discrepancies on a pay stub can raise concerns about a borrower’s creditworthiness, potentially negatively impacting their credit score. Therefore, it is crucial to ensure that pay stubs are accurate and up-to-date to maintain a good credit score. Using Pay Stubs for Budgeting Pay stubs can be a valuable tool for budgeting and financial planning. By reviewing a pay stub, employees can track their income, deductions, and net pay, helping them create a realistic budget. Understanding the breakdown of their earnings allows employees to identify areas where they can cut back on expenses, such as reducing health insurance premiums or adjusting their 401(k) contributions. Additionally, pay stubs provide a clear picture of an employee’s take-home pay, enabling them to make informed decisions about investments, savings, and debt repayment. Regularly reviewing pay stubs can help employees stay on top of their finances and achieve their financial goals. Legal Implications of Pay Stub Errors Pay stub errors can have serious legal implications for employers. Under the Fair Labor Standards Act (FLSA), employers are required to maintain accurate payroll records, including pay stubs. Failure to provide accurate pay stubs can result in fines, penalties, and even lawsuits. Employers must ensure that pay stubs accurately reflect an employee’s wages paid, deductions, and net pay. Additionally, employers must provide pay stubs promptly, as required by state and federal laws. In the event of a pay stub error, employers must correct the mistake promptly and provide an updated pay stub to the affected employee. Ensuring the accuracy and timeliness of pay stubs is not only a legal obligation but also a crucial aspect of maintaining trust and transparency with employees. Benefits of Building a Financial History with Pay Stubs Common Mistakes to Avoid Conclusion Pay stubs are an essential part of financial history, helping individuals track earnings, maintain transparency, and secure loans. Properly managing pay stubs ensures financial security and stability for the future. FAQs on Pay Stubs and Financial History

How Pay Stubs Help Build Your Financial History for a Stronger Future Read More »